Cross-Chain Bridges: Risks & Opportunities for US Crypto Investors

Cross-chain bridges present both exciting opportunities and significant risks for US investors by enabling the transfer of assets across different blockchain networks, enhancing interoperability but also introducing vulnerabilities like smart contract exploits and regulatory uncertainties.

Cross-chain bridges are revolutionizing the crypto landscape by connecting previously isolated blockchains, but what are the key considerations for US investors navigating this new frontier?

Understanding Cross-Chain Bridges

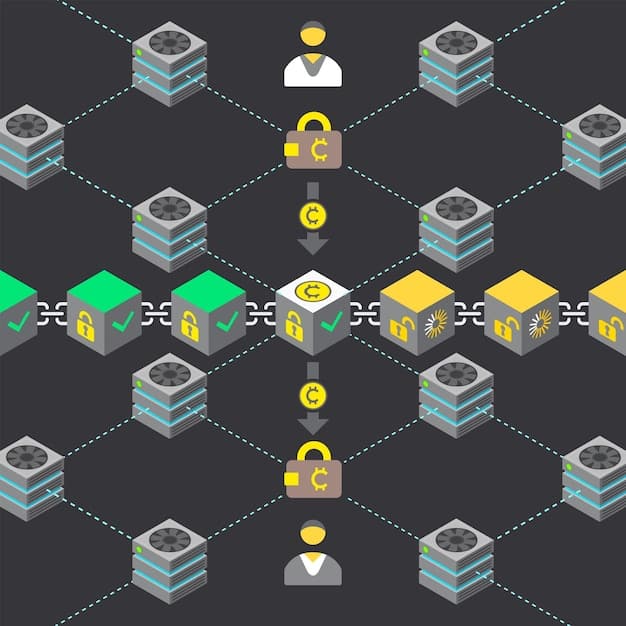

Cross-chain bridges, also known as blockchain bridges, act as conduits, facilitating the transfer of digital assets and data between different blockchain networks. These bridges address a fundamental challenge in the blockchain space: the lack of interoperability between disparate ecosystems. By connecting these isolated systems, they unlock new possibilities for decentralized finance (DeFi), asset mobility, and overall blockchain functionality.

For US investors, understanding the mechanics and implications of cross-chain bridges is crucial for navigating the evolving crypto investment landscape. These bridges open doors to new investment opportunities but also introduce a unique set of risks that must be carefully evaluated.

How Cross-Chain Bridges Work

The functionality of cross-chain bridges relies on several key components and mechanisms designed to ensure secure and efficient transfers. Here’s a closer look at the common operational principles:

- Locking and Minting: The most common mechanism involves locking assets on the origin chain and minting corresponding wrapped assets on the destination chain. This process ensures that the total supply of the asset remains consistent across both chains.

- Validators and Guardians: Many bridges employ a network of validators or guardians who monitor and verify cross-chain transactions. These entities play a critical role in maintaining the integrity of the bridge and preventing fraudulent activities.

- Smart Contracts: Smart contracts are used extensively in cross-chain bridges to automate the locking, minting, and burning processes. These contracts define the rules and conditions for cross-chain transfers, ensuring transparency and security.

Cross-chain bridges are not without their challenges. Technical complexities, security vulnerabilities, and regulatory uncertainties pose significant obstacles to their widespread adoption. For instance, a flaw in the smart contract code can lead to exploits and loss of funds, as has been witnessed in several high-profile bridge hacks.

The Opportunities for US Investors

Cross-chain bridges present several compelling opportunities for US investors looking to diversify their portfolios and capitalize on the growing DeFi ecosystem. These opportunities span across various areas, offering potential for enhanced returns and greater flexibility.

One of the primary advantages of cross-chain bridges is the ability to access a wider range of DeFi applications and protocols that may not be available on a single blockchain. This access can lead to higher yields and more diverse investment options.

Access to Diverse DeFi Ecosystems

By facilitating the transfer of assets between different blockchains, cross-chain bridges enable investors to participate in DeFi ecosystems that offer unique opportunities. Here are some examples:

- Yield Farming: Investors can move their assets to blockchains with higher yield farming opportunities, maximizing their returns.

- Arbitrage: Cross-chain bridges allow for arbitrage opportunities by taking advantage of price differences for the same asset on different exchanges.

- New Protocols: Investors can access innovative DeFi protocols and applications that are exclusive to certain blockchains.

For US investors, this means being able to tap into global DeFi markets and optimize their investment strategies based on the best available opportunities, regardless of the underlying blockchain. This can lead to significant improvements in portfolio performance and risk management.

The Risks and Challenges

Despite the promising opportunities, cross-chain bridges are not without their risks and challenges. US investors need to be aware of these potential pitfalls before investing in or using these technologies. Security vulnerabilities, regulatory uncertainties, and technical complexities are among the key concerns.

One of the most significant risks associated with cross-chain bridges is the potential for security breaches. These bridges often serve as attractive targets for hackers due to the large amounts of assets they hold. Smart contract vulnerabilities, consensus mechanism flaws, and centralized control points can all be exploited to steal funds.

Security Vulnerabilities and Hacks

Several high-profile bridge hacks have demonstrated the real-world risks associated with cross-chain bridges. Here are some common types of security vulnerabilities:

- Smart Contract Exploits: Flaws in the smart contract code can allow attackers to drain funds from the bridge.

- Consensus Mechanism Attacks: Vulnerabilities in the consensus mechanism of the bridge can be exploited to manipulate transactions.

- Centralized Control: Bridges with centralized control points are susceptible to single points of failure and insider attacks.

These security vulnerabilities highlight the importance of thorough auditing and testing of cross-chain bridges. US investors should carefully evaluate the security measures implemented by a bridge before entrusting it with their assets.

Regulatory Considerations for US Investors

The regulatory landscape surrounding cross-chain bridges is still evolving, and US investors need to be aware of the potential implications. Regulatory uncertainty can create additional risks and challenges for those using or investing in these technologies.

Currently, there is no clear regulatory framework specifically addressing cross-chain bridges in the US. This lack of clarity makes it difficult for investors to assess the legal and compliance requirements associated with their use. Different regulatory bodies, such as the SEC and the CFTC, may have overlapping jurisdictions, leading to further uncertainty.

Potential Regulatory Scenarios

Here are some potential regulatory scenarios that US investors should be aware of:

- Securities Regulations: Cross-chain bridges that involve the transfer of assets deemed to be securities may be subject to securities regulations.

- Money Transmission Laws: Bridges that facilitate the transfer of funds across state lines may be subject to money transmission laws.

- Tax Implications: Cross-chain transactions may have tax implications, and investors need to be aware of their reporting obligations.

As the regulatory landscape evolves, US investors should stay informed and seek legal and compliance advice to ensure they are in compliance with all applicable laws and regulations.

Evaluating Cross-Chain Bridges: A Checklist for US Investors

US investors need to conduct thorough due diligence before using or investing in cross-chain bridges. This evaluation should include assessing the bridge’s security measures, technical design, and regulatory compliance.

Here is a checklist of key factors to consider when evaluating cross-chain bridges:

Key Factors to Consider

- Security Audits: Has the bridge undergone thorough security audits by reputable firms?

- Decentralization: How decentralized is the bridge’s governance and validation process?

- Transparency: Is the bridge’s code open-source and publicly auditable?

- Regulatory Compliance: Does the bridge comply with all applicable laws and regulations?

By carefully evaluating these factors, US investors can make more informed decisions and mitigate some of the risks associated with cross-chain bridges. Understanding the technology, its potential vulnerabilities, and the regulatory landscape is essential for responsible investing.

The Future of Cross-Chain Bridges

The future of cross-chain bridges looks promising, with ongoing developments aimed at improving their security, scalability, and interoperability. As the blockchain ecosystem continues to evolve, these bridges are likely to play an increasingly important role in connecting different networks and enabling seamless asset transfers.

One of the key trends in the future of cross-chain bridges is the development of more secure and decentralized architectures. Researchers and developers are exploring new consensus mechanisms, multi-party computation techniques, and zero-knowledge proofs to enhance the security of these bridges.

Emerging Trends and Developments

Here are some emerging trends and developments in the field of cross-chain bridges:

- Layer-2 Scaling Solutions: Integrating cross-chain bridges with layer-2 scaling solutions like rollups can improve their scalability and reduce transaction costs.

- Interoperability Standards: The development of interoperability standards can facilitate the seamless integration of different cross-chain bridges.

- Decentralized Governance: Implementing decentralized governance mechanisms can enhance the resilience and security of cross-chain bridges.

For US investors, staying informed about these emerging trends and developments is essential for understanding the long-term potential of cross-chain bridges and making informed investment decisions.

| Key Point | Brief Description |

|---|---|

| 🔗 Interoperability | Enables asset transfer between blockchains. |

| ⚠️ Security Risks | Vulnerable to smart contract exploits and hacks. |

| ⚖️ Regulatory Uncertainty | Lack of clear regulatory framework in the US. |

| 🚀 DeFi Access | Opens doors to diverse DeFi applications and protocols. |

Frequently Asked Questions

▼

Cross-chain bridges enable the transfer of assets and data between different blockchain networks, enhancing interoperability and functionality. They act as conduits, connecting previously isolated blockchain ecosystems.

▼

The main risks include security vulnerabilities, smart contract exploits, and regulatory uncertainties. These bridges are attractive targets for hackers due to the large amounts of assets they hold.

▼

US investors should look for security audits by reputable firms, assess the decentralization of the bridge, and verify if the code is open-source and publicly auditable to ensure transparency.

▼

The regulatory landscape is still evolving, with no clear framework specifically addressing cross-chain bridges. This uncertainty creates risks, making it crucial for investors to stay informed and seek legal advice.

▼

Future trends include integrating with layer-2 scaling solutions, developing interoperability standards, and implementing decentralized governance mechanisms to enhance security and scalability.

Conclusion

In conclusion, cross-chain bridges offer US investors exciting opportunities to access diverse DeFi ecosystems and enhance portfolio returns. However, it’s crucial to be aware of the inherent risks, including security vulnerabilities and regulatory uncertainties. By conducting thorough due diligence and staying informed about emerging trends, investors can navigate this evolving landscape responsibly.